Maybe this is the one that gets us seriously talking about socio-technical systems and the inherent vulnerability of human factor contributions in any system.

Which will win here; blame or learning?

Continue ReadingMaybe this is the one that gets us seriously talking about socio-technical systems and the inherent vulnerability of human factor contributions in any system.

Which will win here; blame or learning?

Continue ReadingLexisNexis Risk Solutions Fraud Mitigation Study 2017LexisNexis Risk Solutions has issued their annual Fraud Mitigation Study. Goals of ResearchLexisNexis® Risk Solutions commissioned its annual Fraud Mitigation Study to gauge trends and patterns related to fraud within several different industry sectors and government. Objectives of the 2017 study were to: 1) Determine the extent to which fraud extends into more than one industry. For example, in an insurance investigation, evidence may exist that the potential perpetrator also committed benefits fraud, financial fraud, etc. 2) Examine trends related to different types of fraud, including fraud resulting from stolen identities. 3) Explore the extent to which fraud mitigation professionals rely on external data and… Read More

Continue ReadingAmerican Society of Criminology research presentationMy research paper Investigative Challenges of Fraud in Microfinance Institutions has been selected for presentation during the American Society of Criminology (ASC) annual conference in Philadelphia, PA. It is a great honor to have my research included in such a conference. I am grateful for the opportunity. This paper is the culmination of pioneer research as it is the first time the topic has been covered in an academic setting by any college or university. It is my hope that the presentation will highlight not only the findings critical to microfinance institutions and the broader community of businesses and aid foundations operating in developing countries,… Read More

Continue ReadingA recent journal article from PLOS University in Italy examined detecting lies through indicators in mouse movement. Authors Merylin Monaro, Luciano Gamberini, & Giuseppe Sartori collaborated on the paper entitled “The detection of faked identity using unexpected questions and mouse dynamics” (May 18, 2017). Abstract The detection of faked identities is a major problem in security. Current memory-detection techniques cannot be used as they require prior knowledge of the respondent’s true identity. Here, we report a novel technique for detecting faked identities based on the use of unexpected questions that may be used to check the respondent identity without any prior autobiographical information. While truth-tellers respond automatically to unexpected questions,… Read More

Continue ReadingThere is new guidance just released on fraud risk management for COSO principle 8 and the full COSO framework. [Excerpt from the ACFE Forum] We are excited to announce the publication of the new Fraud Risk Management Guide, a resource jointly sponsored by COSO and the ACFE. This guide is an update to the previously released ACFE/IIA/AICPA publication, Managing the Business Risk of Fraud, and is designed to build on both COSO principle 8 and the full COSO Internal Control–Integrated Framework as a foundation for a comprehensive fraud risk management program. The Executive Summary of the guide is attached to this post. We’ve also created a website (ACFE.com/fraudrisktools) that provides interactive tools and other resources… Read More

Continue ReadingSpecializing in antifraud for INSIDER THREAT & FRAUD MANAGEMENT. The first step in effective fraud management is the Fraud Risk Assessment. It provides much more than the inputs required for a risk-based annual audit plan. The results of the evaluation begin the process to allow for the determination of risk appetite, tolerance levels (+/- %), key risk indicators (KRIs), identification of anomalies, and the development of predefined management actions and communication strategy in response to exception reporting. Benefits of the fraud risk assessment include: Visibility into the organization’s fraud risk; Understanding of the risks by department and scheme; Prioritize antifraud efforts and allocate resources effectively by focusing on the risks… Read More

Continue ReadingDOWNLOAD the Report to the Nations on Occupational Fraud and Abuse: 2016 Global Fraud Study by the Association of Certified Fraud Examiners (ACFE).

Continue ReadingTaxonomy of Fraud in Microfinance Background One of the challenges we face in the antifraud industry is the lack of congruity between various thought leaders in how we define fraud and its many schemes. Each industry group or academic expert added great value to the advancement of the antifraud field. However, while every new distinction created a little more clarity, they all seemed to be inputs into a larger equation of the dynamic nature of what we face on a daily basis. In an effort to create a standardized fraud classification system that would apply across all fraud schemes, the Framework for a Taxonomy of Fraud was published by the… Read More

Continue Reading

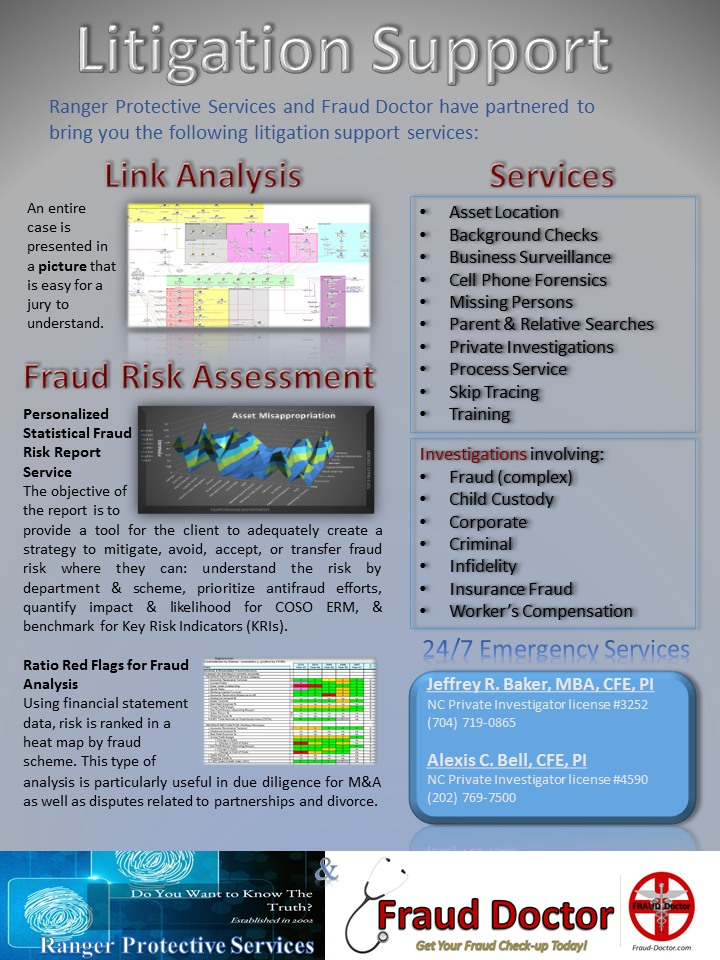

Ranger Protective Services and Fraud Doctor have partnered to bring you the following litigation support services: Link Analysis An entire case is presented in a picture that is easy for a jury to understand. (Sample Link Analysis) Fraud Risk Assessment Personalized Statistical Fraud Risk Report Service The objective of the report is to provide a tool for the client to adequately create a strategy to mitigate, avoid, accept, or transfer fraud risk where they can: understand the risk by department & scheme, prioritize antifraud efforts, quantify impact & likelihood for COSO ERM, & benchmark for Key Risk Indicators (KRIs). (Sample Personalized Statistical Fraud Risk Report) (Order Here) Ratio Red Flags… Read More

Continue Reading

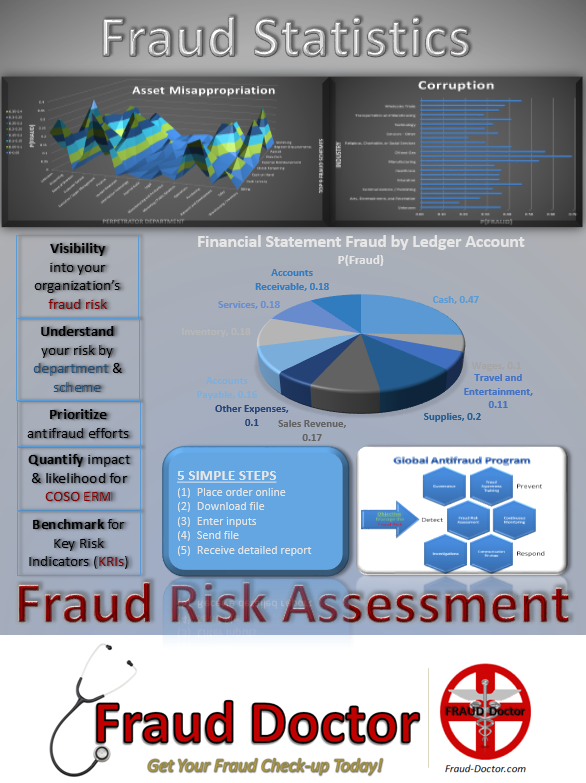

The objective of the report is to provide a tool for management to adequately create a strategy to mitigate, avoid, accept, or transfer fraud risk. A detailed set of analysis is performed so as to be a roadmap for management to take action to address the risk for fraud by providing:

* Visibility into the organization’s fraud risk;

* An understanding of fraud risk by department and scheme;

* Prioritization of antifraud efforts;

* Ability to quantify impact and likelihood for COSO Enterprise Risk Management (ERM); and

* Benchmark for Key Risk Indicators (KRIs).

Continue Reading