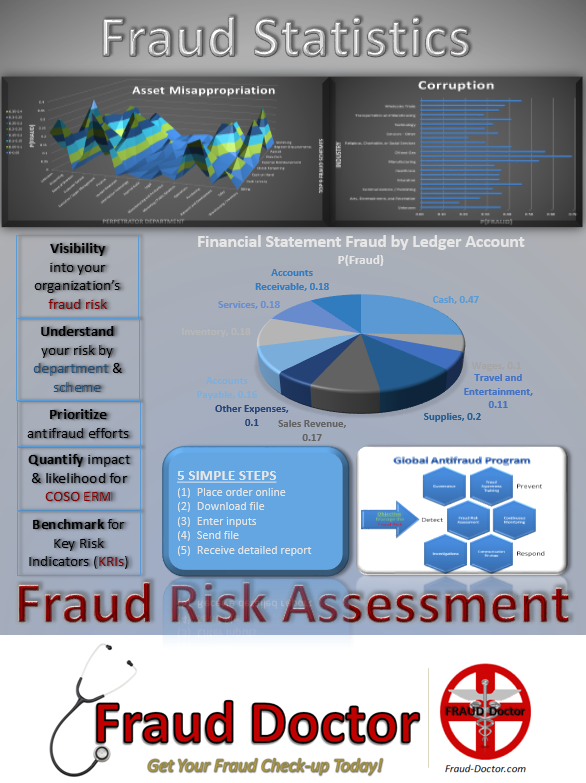

The objective of the report is to provide a tool for management to adequately create a strategy to mitigate, avoid, accept, or transfer fraud risk. A detailed set of analysis is performed so as to be a roadmap for management to take action to address the risk for fraud by providing:

* Visibility into the organization’s fraud risk;

* An understanding of fraud risk by department and scheme;

* Prioritization of antifraud efforts;

* Ability to quantify impact and likelihood for COSO Enterprise Risk Management (ERM); and

* Benchmark for Key Risk Indicators (KRIs).

Continue Reading