There is new guidance just released on fraud risk management for COSO principle 8 and the full COSO framework. [Excerpt from the ACFE Forum] We are excited to announce the publication of the new Fraud Risk Management Guide, a resource jointly sponsored by COSO and the ACFE. This guide is an update to the previously released ACFE/IIA/AICPA publication, Managing the Business Risk of Fraud, and is designed to build on both COSO principle 8 and the full COSO Internal Control–Integrated Framework as a foundation for a comprehensive fraud risk management program. The Executive Summary of the guide is attached to this post. We’ve also created a website (ACFE.com/fraudrisktools) that provides interactive tools and other resources… Read More

Continue ReadingTaxonomy of Fraud in Microfinance

Taxonomy of Fraud in Microfinance Background One of the challenges we face in the antifraud industry is the lack of congruity between various thought leaders in how we define fraud and its many schemes. Each industry group or academic expert added great value to the advancement of the antifraud field. However, while every new distinction created a little more clarity, they all seemed to be inputs into a larger equation of the dynamic nature of what we face on a daily basis. In an effort to create a standardized fraud classification system that would apply across all fraud schemes, the Framework for a Taxonomy of Fraud was published by the… Read More

Continue Reading

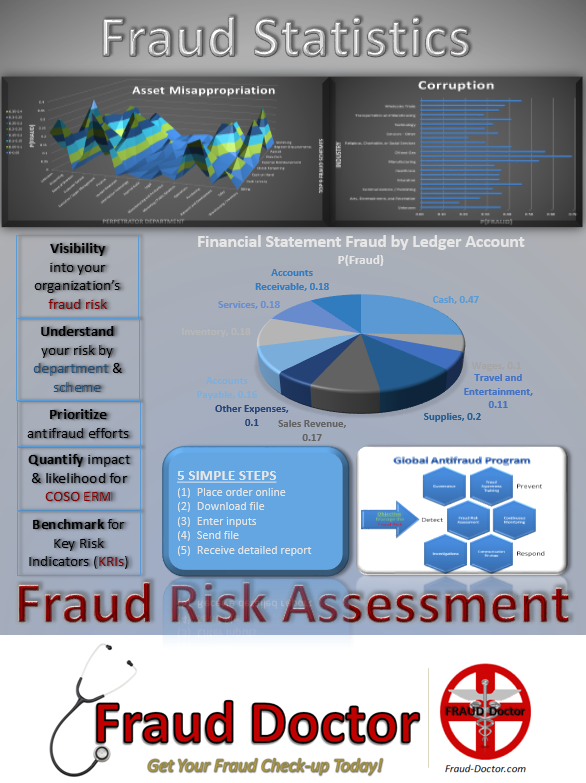

Personalized Statistical Fraud Risk Report

The objective of the report is to provide a tool for management to adequately create a strategy to mitigate, avoid, accept, or transfer fraud risk. A detailed set of analysis is performed so as to be a roadmap for management to take action to address the risk for fraud by providing:

* Visibility into the organization’s fraud risk;

* An understanding of fraud risk by department and scheme;

* Prioritization of antifraud efforts;

* Ability to quantify impact and likelihood for COSO Enterprise Risk Management (ERM); and

* Benchmark for Key Risk Indicators (KRIs).

Continue ReadingNew Benford’s Law Model

We have developed a new model for Benford’s Law analysis. You can analyze naturally occurring numbers (e.g. transaction level data) to see if the actual distributions conform to Benford’s Law. Under certain conditions, deviations from Benford’s could indicate the possibility of human manipulation, i.e. fraud. Therefore, those results would require additional scrutiny. This analysis provides a direction of inquiry. This is a model for Benford’s Law analysis built in MS Excel which calculates graphical and tabular results for the following tests:

Continue Reading