The following are companion documents and images for the book entitled Mortgage Fraud and the Illegal Property Flipping Scheme: A Case Study of United States v. Quintero-Lopez.

ABSTRACT

Mortgage fraud has been described as “a form of bank robbery where the bank is not even aware it has been robbed until months or years later.” Within the United States, an estimated $14 billion (0.66% of all loans) in fraudulent loans were originated in 2009 alone. In United States v. Quintero-Lopez, 15 defendants were indicted on 70 counts in the Southern District of Florida for a mortgage fraud scheme involving 16 fraudulent loans totaling $6 million in disbursements. This case study examines over 3 ½ years of activity, incorporates a detailed risk assessment and highlights best practices for prevention, detection, and investigation. The methodology of the scheme is detailed in a process flowchart, link analysis, and timeline of events.

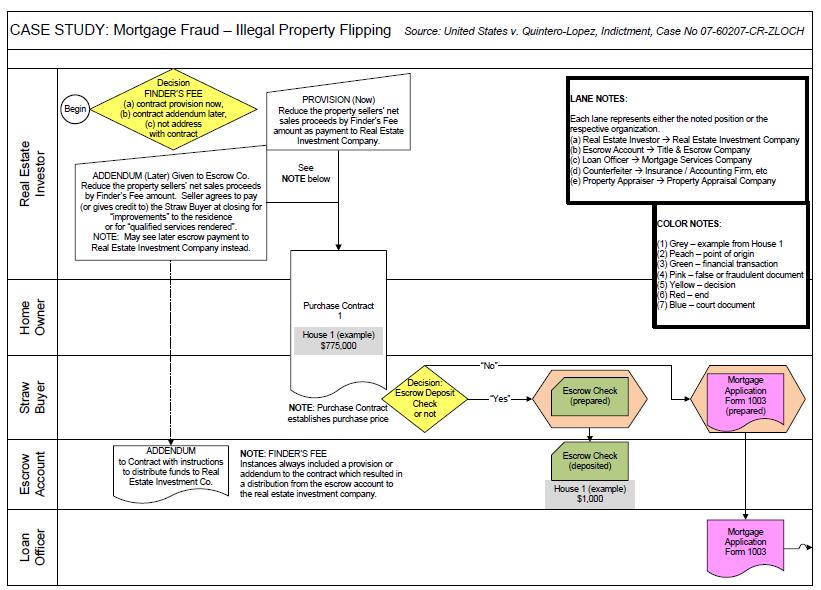

PROCESS FLOWCHART

For a detailed process flowchart of the fraud scheme specific to United States v. Quintero-Lopez (2007):

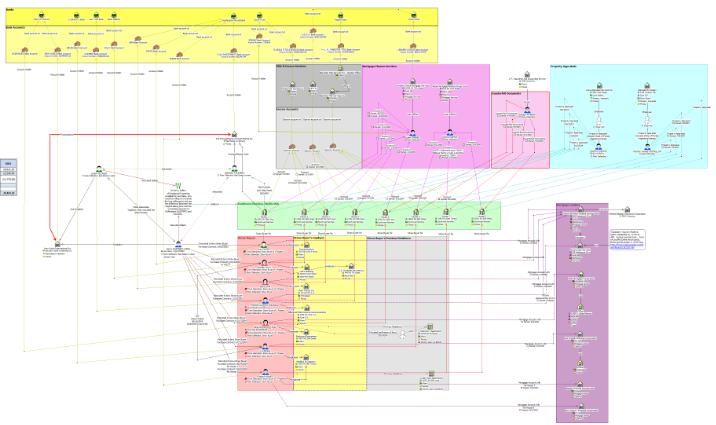

LINK ANALYSIS

Using Analyst’s Notebook software, the following was created for United States v. Quintero-Lopez (2007):

- Link analysis depicting the relationship of key players

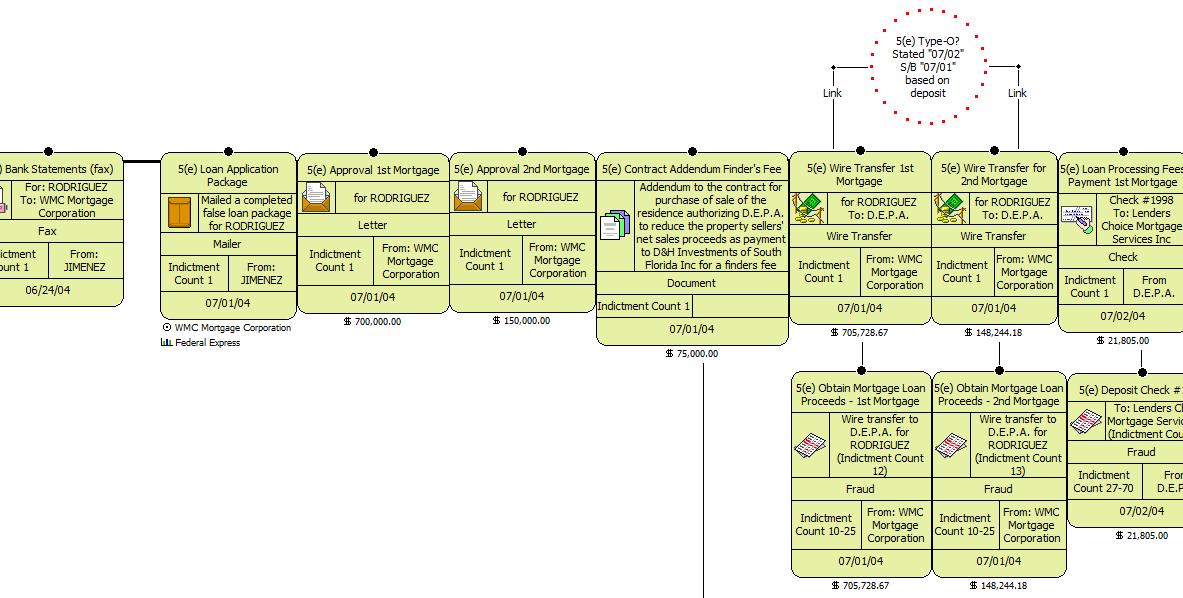

TIMELINE OF EVENTS

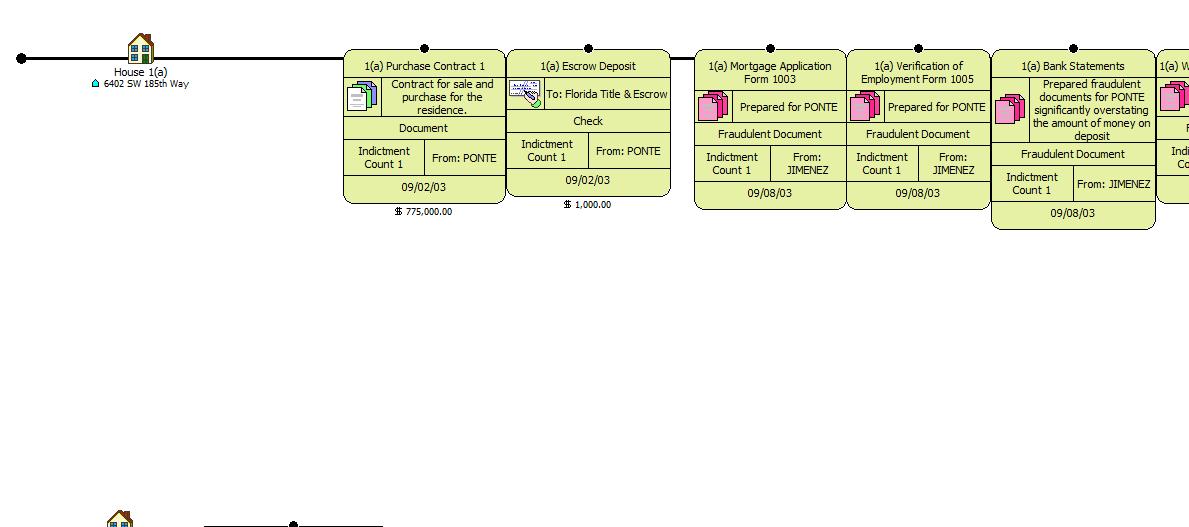

Using Analyst’s Notebook software, the following were created for United States v. Quintero-Lopez (2007):

- Timeline chart depicting the chronology of events:

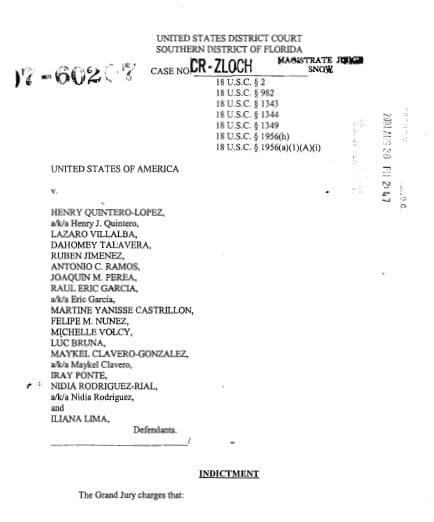

INDICTMENT

United States v. Quintero-Lopez (2007)

Case No 07-60207-CR-ZLOCH

Indictment dated August 30, 2007

Get your copy of the paperback book today: Mortgage Fraud and the Illegal Property Flipping Scheme: A Case Study of United States v. Quintero-Lopez.

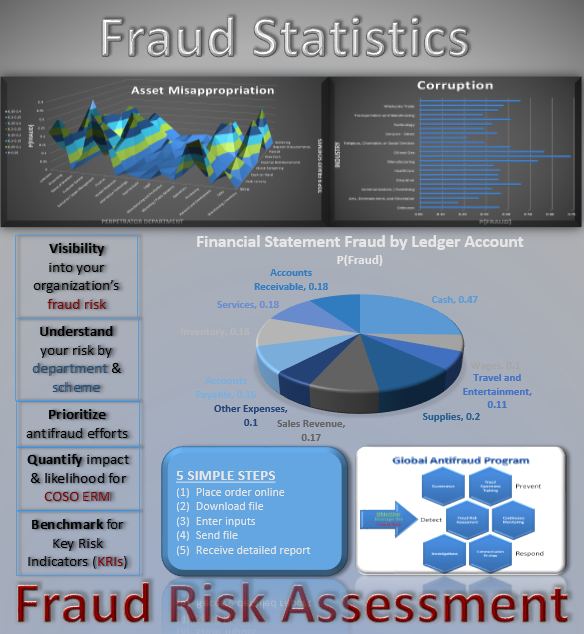

Also see our latest report service: Personalized Statistical Fraud Risk Report