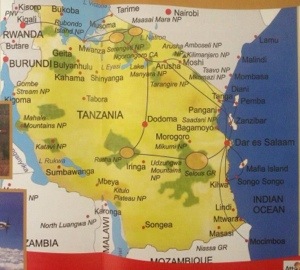

I had the pleasure of teaching a three and a half day antifraud seminar at the Serena resort in Dar es Salaam, Tanzania, Africa. Participants included C-Suite, management from Legal, Banking Services, Internal Controls, and Global Corporate Audit departments from many countries across the continent.

Topics included:

- Fraud Toolkit – protocols and what to expect when an investigation occurs; the DOs and DON’Ts.

- Basic Axioms and Theory – investigative terminology and concepts.

- Reporting Fraud Calculations – how to determine the three calculations needed when reporting fraud. (See my article).

- Fraud Flowcharts – how to design and present a flowchart of the scheme.

- Classifying Fraud Schemes – determining which schemes are involved. (See my article).

- Electronic Evidence File Structure – the 400+ steps / considerations involved in a complex international fraud investigation and the design of the system to classify and document each aspect. (Based on my in-process book entitled “Electronic Evidence File Structure for International Fraud: Investigative Roadmap“.)

- Fraud Risk Assessment – how to conduct an international fraud risk assessment. (Based on my design and implementation).

- Fraud Statistics – how to prioritize resources to address risk based on results from applied fraud statistics.

- Ratio Red Flags for Fraud – financial statement analysis to calculate fraud risk by scheme. (See my book).

- Benford’s Law – mathematical law as applied to fraud detection when analyzing data. (Based on Mark Nigrini‘s research and my design, the Bell Method).

It was a sincere pleasure to teach that course. I was encouraged by the fantastic questions and high level of involvement from the attendees. I look forward to returning for the next course.