Blockchain Technology for Compliance and Managing Risk (Part 2) Join us on this episode of FraudCast as we discuss blockchain technology for compliance and managing risk with Ian Worrall, CEO of Encrypted Labs. We answer questions such as: How did you get started? How do you address people being skeptical about robots? Regulatory concerns? Private and/or government? And much more. YouTube link: https://youtu.be/Uw4gsd4z-pQ Also see:Unlocking Economic Advantage with Blockchain: A guide for asset managers (J.P. Morgan, 2016) PDFCall for Subject Matter Experts to become a guest speaker on FraudCast.Helpful Speaker Tips for step by step instructions on the interview process.

Continue ReadingFraudCast – Auto Fraud

Join us on this episode of FraudCast as we discuss fraud in the automotive industry with Todd Wolf, Vehicle Theft Investigator of the California Highway Patrol. We answer questions such as: Why is auto fraud an issue? Who are the victims in auto fraud scams? What are some of the red flags for auto fraud? How can you protect yourself from auto fraud? And much more.

Continue ReadingFraudCast – Blockchain Technology for Compliance and Managing Risk

Blockchain Technology for Compliance and Managing Risk Join us on this episode of FraudCast as we discuss blockchain technology for compliance and managing risk with Ian Worrall, CEO of Encrypted Labs. We answer questions such as: What is Blockchain Technology? How can it be used to reduce systemic Fraud? What is the competitive advantage of BigchainDB? And much more. YouTube link: https://youtu.be/8m9RblWfORM Also see:Unlocking Economic Advantage with Blockchain: A guide for asset managers (J.P. Morgan, 2016) PDFCall for Subject Matter Experts to become a guest speaker on FraudCast.Helpful Speaker Tips for step by step instructions on the interview process.

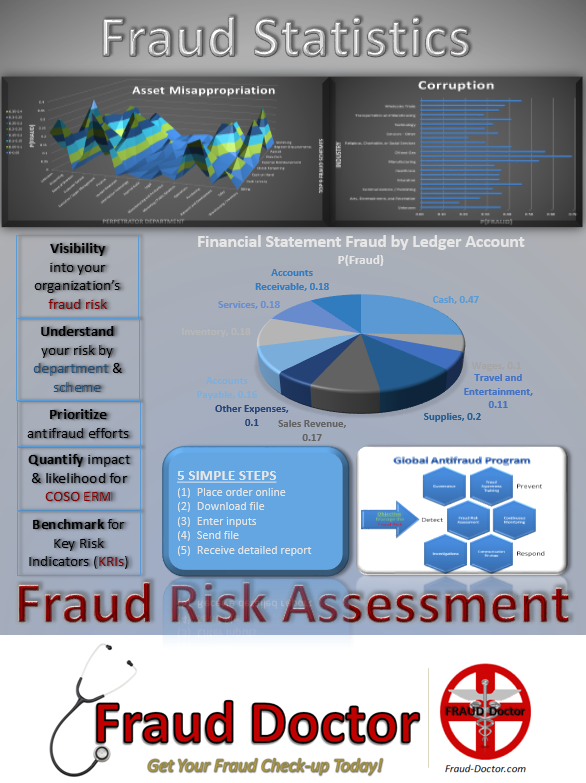

Continue ReadingFraud Risk Assessment

Specializing in antifraud for INSIDER THREAT & FRAUD MANAGEMENT. The first step in effective fraud management is the Fraud Risk Assessment. It provides much more than the inputs required for a risk-based annual audit plan. The results of the evaluation begin the process to allow for the determination of risk appetite, tolerance levels (+/- %), key risk indicators (KRIs), identification of anomalies, and the development of predefined management actions and communication strategy in response to exception reporting. Benefits of the fraud risk assessment include: Visibility into the organization’s fraud risk; Understanding of the risks by department and scheme; Prioritize antifraud efforts and allocate resources effectively by focusing on the risks… Read More

Continue ReadingTaxonomy of Fraud in Microfinance

Taxonomy of Fraud in Microfinance Background One of the challenges we face in the antifraud industry is the lack of congruity between various thought leaders in how we define fraud and its many schemes. Each industry group or academic expert added great value to the advancement of the antifraud field. However, while every new distinction created a little more clarity, they all seemed to be inputs into a larger equation of the dynamic nature of what we face on a daily basis. In an effort to create a standardized fraud classification system that would apply across all fraud schemes, the Framework for a Taxonomy of Fraud was published by the… Read More

Continue ReadingFraudCast – Cloud Computing

The other day I was at a client site assisting them with building their global antifraud program. While there, I realized they did not have a process for back-up related to employees who travelled. They had a robust system-level process for backing up desktops and laptops while they were actively connected to their network. However, there was no process in place (manual or otherwise) to back-up the data on employee’s laptops when they were travelling and thus not connected to the organization’s network. Many of the thousands of people who travelled would be in the field (yes, sometimes an actual field near a tiny village in the jungle) for weeks… Read More

Continue ReadingCell Phone Forensics

Your company can benefit from the new technology advances in cell phone forensics. Watch this short video for just a few of the ways cell phone forensics can help you with your fraud management program.

Continue ReadingFraudCast – Background Checks with Rachid Zahidi

[youtube https://www.youtube.com/watch?v=rNn42gM8CG4] (Video 15:14) YouTube link Welcome to FraudCast, your destination for fraud management. Today we are talking with Rachid Zahidi, CEO of Sentinel Screenings, about background checks and also about his book “The Business Immunity System: The Pitfalls and Side Effects of Data Handling, Privacy Issues, and Background Checks.” (www.sbchecks.com and www.sentinelscreening.com) If you would like to be a guest speaker on FraudCast, please submit your request here.

Continue Reading

Litigation Support Services

Ranger Protective Services and Fraud Doctor have partnered to bring you the following litigation support services: Link Analysis An entire case is presented in a picture that is easy for a jury to understand. (Sample Link Analysis) Fraud Risk Assessment Personalized Statistical Fraud Risk Report Service The objective of the report is to provide a tool for the client to adequately create a strategy to mitigate, avoid, accept, or transfer fraud risk where they can: understand the risk by department & scheme, prioritize antifraud efforts, quantify impact & likelihood for COSO ERM, & benchmark for Key Risk Indicators (KRIs). (Sample Personalized Statistical Fraud Risk Report) (Order Here) Ratio Red Flags… Read More

Continue Reading

Personalized Statistical Fraud Risk Report

The objective of the report is to provide a tool for management to adequately create a strategy to mitigate, avoid, accept, or transfer fraud risk. A detailed set of analysis is performed so as to be a roadmap for management to take action to address the risk for fraud by providing:

* Visibility into the organization’s fraud risk;

* An understanding of fraud risk by department and scheme;

* Prioritization of antifraud efforts;

* Ability to quantify impact and likelihood for COSO Enterprise Risk Management (ERM); and

* Benchmark for Key Risk Indicators (KRIs).

Continue Reading