Join us on October 3rd in Nashville, TN for the Institute of Internal Auditors (IIA) Nashville Chapter’s annual conference. This year’s topic is Fraud Risk Management.

Continue ReadingWhat exactly is a Fraud Audit?

Many of you may have heard of the term “fraud audit” or maybe you heard someone talking about a “forensic audit”, but what is it? In this video, we examine 6 distinctions between an audit and an investigation to answer that very question.

Continue ReadingFraudCast – Interviewing in Fraud Matters

Join us on this episode of FraudCast as we discuss interviewing and interrogations in the fraud environment with Mark Anderson, Director of Training & Development of Anderson Investigative Associates LLC. We answer questions such as: How important are interviews in the digital age? What are areas of emphasis required in a fraud subject interview? How important is rapport? And much more. YouTube link: https://youtu.be/I_EvmU_V9ow Also see:Call for Subject Matter Experts to become a guest speaker on FraudCast.Helpful Speaker Tips for step by step instructions on the interview process.Join us on this episode of FraudCast as we discuss interviewing and interrogations in the fraud environment with Mark Anderson, Director of Training & Development of Anderson Investigative Associates LLC. We answer questions such as: How important are interviews in… Read More

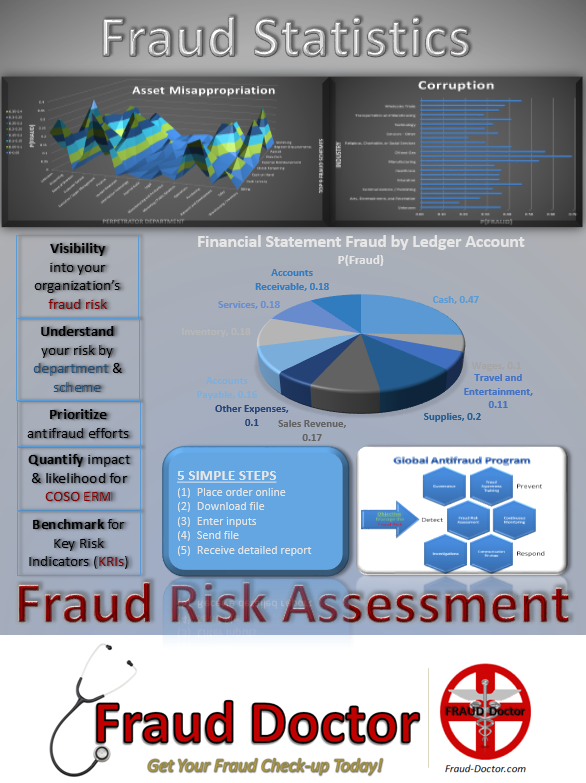

Continue ReadingFraud Risk Assessment

Specializing in antifraud for INSIDER THREAT & FRAUD MANAGEMENT. The first step in effective fraud management is the Fraud Risk Assessment. It provides much more than the inputs required for a risk-based annual audit plan. The results of the evaluation begin the process to allow for the determination of risk appetite, tolerance levels (+/- %), key risk indicators (KRIs), identification of anomalies, and the development of predefined management actions and communication strategy in response to exception reporting. Benefits of the fraud risk assessment include: Visibility into the organization’s fraud risk; Understanding of the risks by department and scheme; Prioritize antifraud efforts and allocate resources effectively by focusing on the risks… Read More

Continue ReadingTaxonomy of Fraud in Microfinance

Taxonomy of Fraud in Microfinance Background One of the challenges we face in the antifraud industry is the lack of congruity between various thought leaders in how we define fraud and its many schemes. Each industry group or academic expert added great value to the advancement of the antifraud field. However, while every new distinction created a little more clarity, they all seemed to be inputs into a larger equation of the dynamic nature of what we face on a daily basis. In an effort to create a standardized fraud classification system that would apply across all fraud schemes, the Framework for a Taxonomy of Fraud was published by the… Read More

Continue ReadingCell Phone Forensics

Your company can benefit from the new technology advances in cell phone forensics. Watch this short video for just a few of the ways cell phone forensics can help you with your fraud management program.

Continue Reading

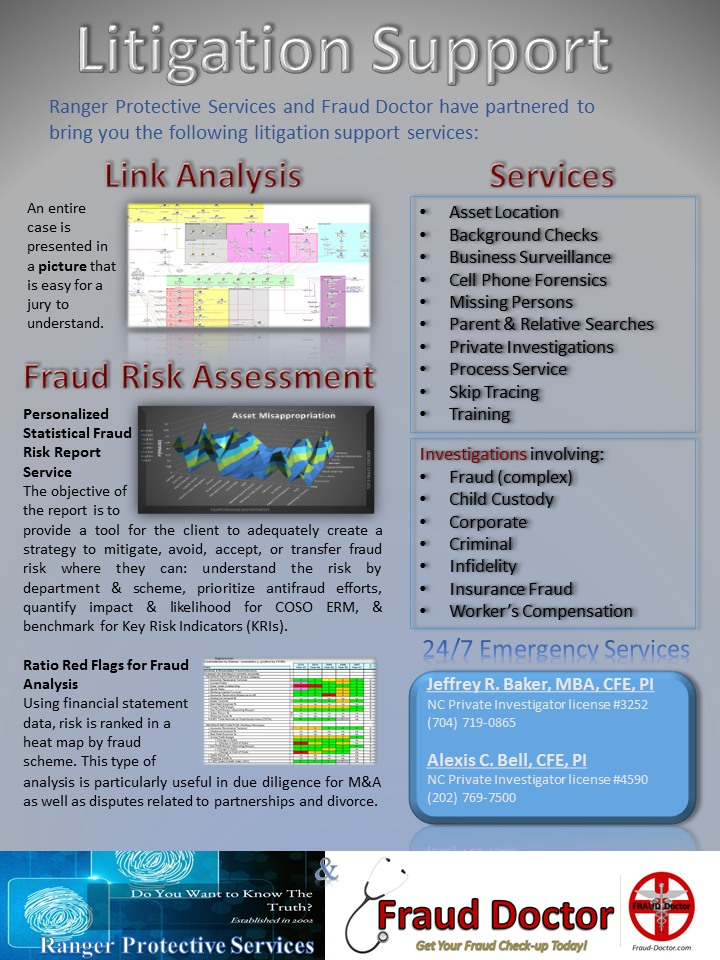

Litigation Support Services

Ranger Protective Services and Fraud Doctor have partnered to bring you the following litigation support services: Link Analysis An entire case is presented in a picture that is easy for a jury to understand. (Sample Link Analysis) Fraud Risk Assessment Personalized Statistical Fraud Risk Report Service The objective of the report is to provide a tool for the client to adequately create a strategy to mitigate, avoid, accept, or transfer fraud risk where they can: understand the risk by department & scheme, prioritize antifraud efforts, quantify impact & likelihood for COSO ERM, & benchmark for Key Risk Indicators (KRIs). (Sample Personalized Statistical Fraud Risk Report) (Order Here) Ratio Red Flags… Read More

Continue Reading

Personalized Statistical Fraud Risk Report

The objective of the report is to provide a tool for management to adequately create a strategy to mitigate, avoid, accept, or transfer fraud risk. A detailed set of analysis is performed so as to be a roadmap for management to take action to address the risk for fraud by providing:

* Visibility into the organization’s fraud risk;

* An understanding of fraud risk by department and scheme;

* Prioritization of antifraud efforts;

* Ability to quantify impact and likelihood for COSO Enterprise Risk Management (ERM); and

* Benchmark for Key Risk Indicators (KRIs).

Continue ReadingNew Benford’s Law Model

We have developed a new model for Benford’s Law analysis. You can analyze naturally occurring numbers (e.g. transaction level data) to see if the actual distributions conform to Benford’s Law. Under certain conditions, deviations from Benford’s could indicate the possibility of human manipulation, i.e. fraud. Therefore, those results would require additional scrutiny. This analysis provides a direction of inquiry. This is a model for Benford’s Law analysis built in MS Excel which calculates graphical and tabular results for the following tests:

Continue ReadingTraining in Tanzania, Africa

I had the pleasure of teaching a three and a half day antifraud seminar at the Serena resort in Dar es Salaam, Tanzania, Africa. Participants included C-Suite, management from Legal, Banking Services, Internal Controls, and Global Corporate Audit departments from many countries across the continent. Topics included:

Continue Reading