There is new guidance just released on fraud risk management for COSO principle 8 and the full COSO framework. [Excerpt from the ACFE Forum] We are excited to announce the publication of the new Fraud Risk Management Guide, a resource jointly sponsored by COSO and the ACFE. This guide is an update to the previously released ACFE/IIA/AICPA publication, Managing the Business Risk of Fraud, and is designed to build on both COSO principle 8 and the full COSO Internal Control–Integrated Framework as a foundation for a comprehensive fraud risk management program. The Executive Summary of the guide is attached to this post. We’ve also created a website (ACFE.com/fraudrisktools) that provides interactive tools and other resources… Read More

Continue ReadingWeirdest Insurance Fraud Claims of All Time

Check out these fraudulent insurance claims… Infographic courtesy of Damien Gallagher of Top Quote in Ireland.

Continue ReadingTaxonomy of Fraud in Microfinance

Taxonomy of Fraud in Microfinance Background One of the challenges we face in the antifraud industry is the lack of congruity between various thought leaders in how we define fraud and its many schemes. Each industry group or academic expert added great value to the advancement of the antifraud field. However, while every new distinction created a little more clarity, they all seemed to be inputs into a larger equation of the dynamic nature of what we face on a daily basis. In an effort to create a standardized fraud classification system that would apply across all fraud schemes, the Framework for a Taxonomy of Fraud was published by the… Read More

Continue Reading

Mortgage Fraud

The following are companion documents and images for the book entitled Mortgage Fraud and the Illegal Property Flipping Scheme: A Case Study of United States v. Quintero-Lopez. ABSTRACT Mortgage fraud has been described as “a form of bank robbery where the bank is not even aware it has been robbed until months or years later.” Within the United States, an estimated $14 billion (0.66% of all loans) in fraudulent loans were originated in 2009 alone. In United States v. Quintero-Lopez, 15 defendants were indicted on 70 counts in the Southern District of Florida for a mortgage fraud scheme involving 16 fraudulent loans totaling $6 million in disbursements. This case study examines over 3… Read More

Continue Reading

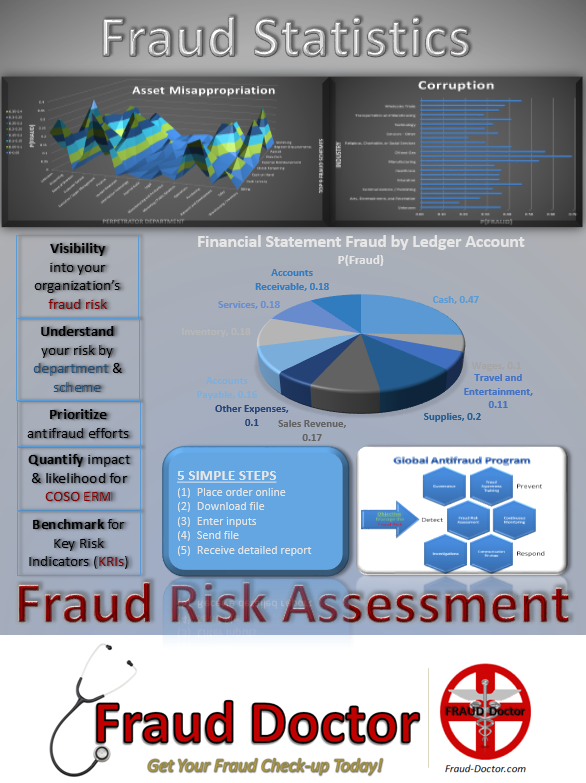

Personalized Statistical Fraud Risk Report

The objective of the report is to provide a tool for management to adequately create a strategy to mitigate, avoid, accept, or transfer fraud risk. A detailed set of analysis is performed so as to be a roadmap for management to take action to address the risk for fraud by providing:

* Visibility into the organization’s fraud risk;

* An understanding of fraud risk by department and scheme;

* Prioritization of antifraud efforts;

* Ability to quantify impact and likelihood for COSO Enterprise Risk Management (ERM); and

* Benchmark for Key Risk Indicators (KRIs).

Continue ReadingSocial Engineering (CBT)

Social engineers get useful information from unsuspecting people and use it in potentially nefarious ways. Simple conversations provide the opportunity for the social engineer to get seemingly benign information from individuals over the course of one or many encounters. That information can then be combined with other open source information to then provide the social engineer with everything they need to carry out an attack on a system, enter a secure building, or any number of applications that could cause harm to your organization. Protect your employees by educating them about the direct implications this can have on your company. Teach them what to look for so they can avoid… Read More

Continue ReadingNew Benford’s Law Model

We have developed a new model for Benford’s Law analysis. You can analyze naturally occurring numbers (e.g. transaction level data) to see if the actual distributions conform to Benford’s Law. Under certain conditions, deviations from Benford’s could indicate the possibility of human manipulation, i.e. fraud. Therefore, those results would require additional scrutiny. This analysis provides a direction of inquiry. This is a model for Benford’s Law analysis built in MS Excel which calculates graphical and tabular results for the following tests:

Continue ReadingReputation Impact From Fraud

Reputation Impact From Fraud Stakeholders beware. A declining reputation can have a significant impact on an organization. Just two and a half years after the initial public offering (IPO) of Basin Water, Inc., they were forced to issue a press release that would prove to be the beginning of the end. The company was defunct within one year of the initial press release which indicated a potential problem involving the operational risk of financial statement fraud pertaining to revenue recognition. This is merely one example where 72% of Securities and Exchange Commission (SEC) investigations in fiscal year 2010 identified deficiencies with 42% resulting in “significant findings”. When those issues are… Read More

Continue Reading

ACFE Report to the Nations 2012 Global Fraud Survey

ACFE Report to the Nations 2012 Global Fraud Survey Issued Tuesday, May 8, 2012 Summary of Findings ___________________ • Survey participants estimated that the typical organization loses 5% of its revenues to fraud each year. Applied to the 2011 Gross World Product, this figure translates to a potential projected annual fraud loss of more than $3.5 trillion

Continue Reading

Just how many fraud schemes are there?

Just how many fraud schemes are there? You may be surprised. Here is a map of just occupational fraud schemes; where a person uses their job to facilitate the fraud. They are the most common schemes found in corporate fraud. However, depending on the industry, there are a host of industry-specific schemes that could be incorporated into each of these. Each fraud scheme is different with varying methodologies, positions of trust, and motives. Sometimes one fraud scheme is used by one fraudster and other times multiple schemes are used by many people. Download a free listing (PDF) of Occupational Fraud Schemes (9-pages) Request a free consultation

Continue Reading